Safeguard Your Home and Enjoyed Ones With Affordable Home Insurance Coverage Program

Significance of Affordable Home Insurance Policy

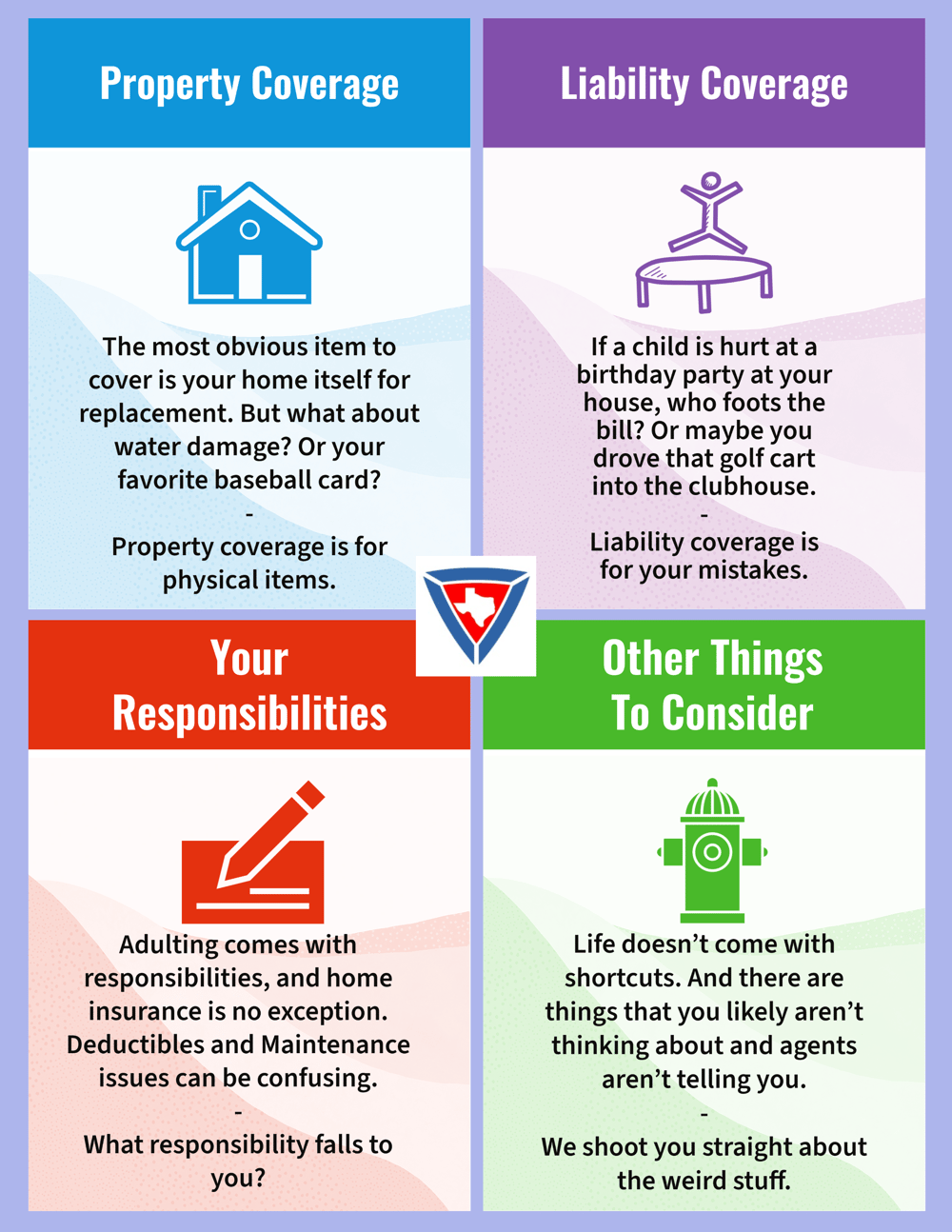

Securing inexpensive home insurance is critical for guarding one's building and economic wellness. Home insurance provides security versus different risks such as fire, theft, natural calamities, and personal responsibility. By having an extensive insurance plan in position, home owners can relax guaranteed that their most considerable financial investment is safeguarded in case of unexpected situations.

Affordable home insurance coverage not only supplies financial security however also provides assurance (San Diego Home Insurance). When faced with increasing residential property worths and construction costs, having a cost-effective insurance plan guarantees that home owners can easily restore or fix their homes without facing significant monetary concerns

Moreover, cost effective home insurance can also cover personal possessions within the home, supplying repayment for things damaged or taken. This coverage prolongs past the physical framework of your house, protecting the components that make a residence a home.

Insurance Coverage Options and Purviews

When it comes to protection restrictions, it's important to comprehend the maximum amount your plan will pay out for each sort of insurance coverage. These restrictions can vary depending upon the plan and insurance firm, so it's crucial to assess them carefully to ensure you have ample protection for your home and possessions. By recognizing the protection options and restrictions of your home insurance coverage, you can make informed decisions to safeguard your home and loved ones efficiently.

Variables Influencing Insurance Policy Expenses

Numerous variables significantly affect the costs of home insurance policy policies. The place of your home plays an essential duty in identifying the insurance policy costs.

Furthermore, the kind of insurance coverage you select straight impacts the cost of your insurance coverage. Selecting added coverage alternatives such as flooding insurance policy or quake coverage will certainly boost your premium. In a similar way, choosing greater coverage limits will certainly cause greater prices. Your insurance deductible amount can likewise affect your insurance costs. A higher insurance deductible typically implies lower premiums, however you will need to pay more expense in case of an insurance claim.

Furthermore, your credit rating, asserts background, and the insurance provider you pick can all affect the cost of your home insurance coverage. By considering these variables, you can make enlightened decisions to help manage your insurance policy sets you back effectively.

Comparing Suppliers and quotes

In addition to comparing quotes, it is essential to evaluate the over here online reputation and monetary stability of the insurance coverage carriers. Search for customer reviews, rankings from independent firms, and any kind of history of problems or regulative actions. A dependable insurance coverage copyright ought to have an excellent performance history of promptly refining claims and supplying superb customer care.

Moreover, take into consideration the specific coverage features used by each service provider. Some insurers might provide extra advantages such as identity theft defense, devices breakdown insurance coverage, or protection for high-value items. By very carefully contrasting providers and quotes, you can make an educated choice and pick the home insurance coverage strategy that finest fulfills your requirements.

Tips for Saving on Home Insurance

After extensively contrasting quotes and suppliers to find the most appropriate protection for your demands and budget plan, it is sensible to explore efficient strategies for minimizing home insurance policy. Among the most considerable ways to reduce home insurance policy is by packing your plans. Many insurer use discounts if you acquire numerous policies from them, such as incorporating your home and auto insurance coverage. Increasing your home's security measures can also lead to cost savings. Installing protection systems, smoke alarm, deadbolts, or an automatic sprinkler can minimize the risk of damage or theft, potentially decreasing your insurance policy costs. Additionally, preserving an excellent credit rating can positively impact your home insurance coverage prices. Insurance firms usually consider credit report when determining costs, so paying bills promptly and managing your credit rating responsibly can result in reduced insurance policy expenses. Finally, routinely reviewing and updating your plan to mirror any type of changes in your house or conditions can guarantee you are not paying for protection you no more need, assisting you conserve cash on your home insurance policy costs.

Conclusion

In verdict, safeguarding your home and liked ones with budget-friendly home insurance policy is essential. Carrying out ideas for saving on home insurance can likewise help you protect the needed defense for your home without breaking the financial institution.

By unraveling the intricacies of home insurance coverage plans and discovering sensible methods for safeguarding affordable insurance coverage, you can guarantee that your home and enjoyed ones are well-protected.

Home insurance policy policies typically use several protection choices to secure your home and possessions moved here - San Diego Home Insurance. By comprehending the protection choices and limitations of your home my explanation insurance policy, you can make educated choices to secure your home and liked ones properly

Routinely examining and upgrading your plan to mirror any type of modifications in your home or situations can ensure you are not paying for coverage you no longer demand, aiding you conserve cash on your home insurance coverage costs.

In conclusion, protecting your home and loved ones with inexpensive home insurance is crucial.